Gearing up for FLAG: How Companies Can Effectively Disclose and Set Targets in Forest, Land, and Agriculture

Understanding FLAG Disclosure and the Timely Emphasis on Carbon Accounting in Land-Based Supply Chains

With the release of the finalized Land Sector and Removals GHG (Greenhouse Gas) reporting guidance by the GHG Protocol expected in Q1 20251, many corporate sustainability teams may be uncertain on what steps to take to prepare themselves for these new reporting standards. At Schneider Electric, our GHG advisory teams have been working closely with our clients to tackle emissions reporting and target setting associated with FLAG. We have early insights into the main hurdles most corporates face and proven steps they can take to overcome. The main message: Don’t wait. Taking early action now to operationalize FLAG emissions accounting will help you to adopt the new reporting guidelines with confidence and ease and pave the way for decarbonizing FLAG emissions early on.

With the release of the finalized Land Sector and Removals GHG (Greenhouse Gas) reporting guidance by the GHG Protocol expected in Q1 20251, many corporate sustainability teams may be uncertain on what steps to take to prepare themselves for these new reporting standards. At Schneider Electric, our GHG advisory teams have been working closely with our clients to tackle emissions reporting and target setting associated with FLAG. We have early insights into the main hurdles most corporates face and proven steps they can take to overcome. The main message: Don’t wait. Taking early action now to operationalize FLAG emissions accounting will help you to adopt the new reporting guidelines with confidence and ease and pave the way for decarbonizing FLAG emissions early on.

It should come as no surprise that the global carbon accounting authorities are putting increased emphasis on FLAG emissions (also referred to as Agriculture, Forest and Other Land Use [AFOLU]). Around 37% of earth’s total land area is used for agricultural purposes2 (equaling about 4.9 billion hectares3). Agricultural and forestry production is significantly carbon intensive, where 22% of global emissions can be attributed to AFOLU. This also coincides with increased pressure from other NGOs and regulators to bring nature into the ESG (Environmental, Social, and Governance) materiality fold. For example, the recent formation of the Taskforce on Nature-related Financial Disclosure, introduction of Science Based Targets for Nature, EU Deforestation Regulation (EUDR), UK Biodiversity Net Gain, Corporate Sustainability Reporting Directive (CSRD) and EU Nature Restoration Law. All this suggests that the increased emphasis on addressing nature-related business impacts is here to stay.

GHG Protocol Latest Guidance: A Significant Step in Corporate GHG Reporting

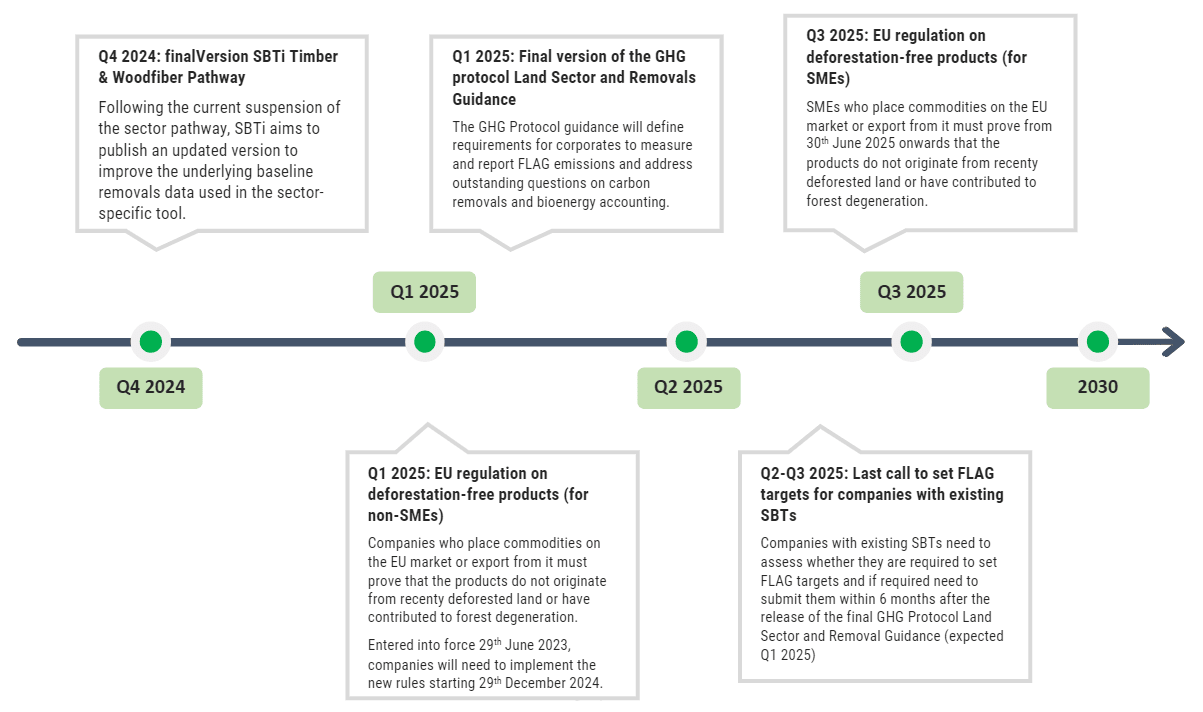

Despite the obvious need for more transparency in agricultural and forestry value chains, until recently there has been a lack of standardized guidance for corporates to reliably measure and take action towards addressing GHG emissions. That is until September 2022, when the GHG Protocol (the leading guidance provider for corporate GHG disclosures) published a draft version of the Land Sector and Removals Guidance, officially defining requirements for corporates to measure and report on emissions from FLAG. A culmination of years of collaboration with industry leaders, academics, and NGOs, this guidance signals a step change in corporate GHG reporting obligations and is intended to help standardize requirements for measuring GHG-contributing activities across owned operations and the value chain. Although the finalized guidance is not expected until Q1 of 2025, reporting on FLAG emissions is already a requirement for companies seeking to set ambitious climate goals through Science-Based Targets initiative (SBTi) and is cross cutting with other regulatory reporting obligations such as EUDR (which will come into effect on December 30th, 2024). Therefore, corporates should not wait to begin incorporating FLAG GHG accounting into their yearly GHG inventories.

Three Key Challenges for FLAG Accounting and Target Setting

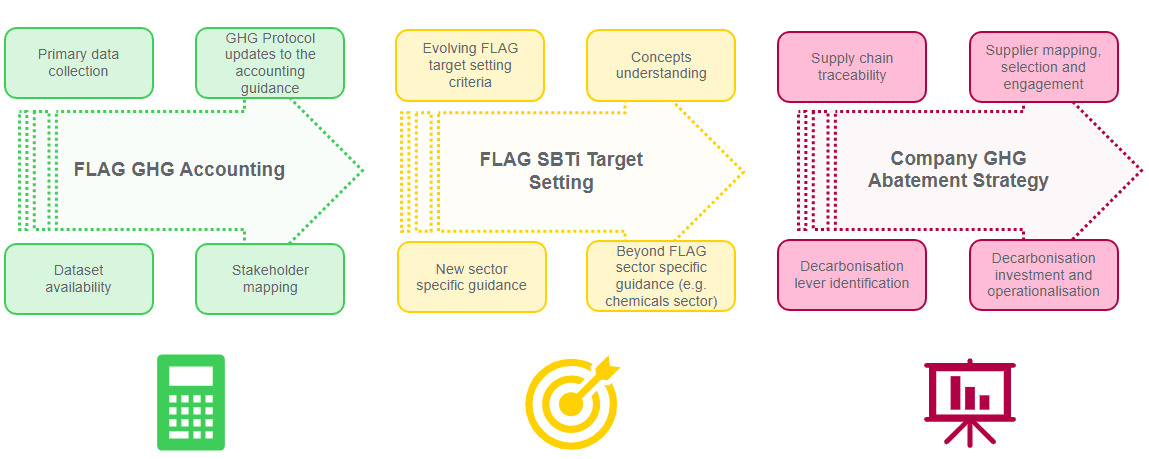

Our experience has proven that most corporates face a similar set of issues in regard to FLAG emissions accounting and target setting (Figure 1). As with many initiatives in the GHG reporting landscape, most relate to data.

.

Figure 1 The key challenges in FLAG accounting and addressing FLAG emissions.

.

Challenge #1: Company-specific internal data collection: Collecting comprehensive and quality data for FLAG-related activities in your company’s owned operations or within its value chain will be the first hurdle for most corporates to contend with. Second only to lack of guidance, a lack of data is the number one reason cited by companies for not reporting on GHG activities associated with FLAG4. As opposed to traditional energy data, the complexity and fragmentation of agricultural supply chains pose significant challenges to achieving high-quality data, often requiring collaboration among various stakeholders and the use of advanced digital technologies. A key component to FLAG emissions accounting (in addition to adherence with the EUDR) is traceability, or a company’s ability to track agricultural commodities back to their production origin. According to the 2022 Forest 500 report (Forest 500 2022a) and a joint report by CDP and AFi (AFi and CDP 2022), only 23 percent of reporting companies (157) can trace more than 90 percent of the volumes they produce or source back to the municipality level or equivalent for at least one commodity5.

Challenge #2: Finding fit for use and accurate secondary datasets: Following the collection of internal company data, finding the most accurate emission factor datasets for GHG accounting still proves to be challenging for corporates. We have found that many datasets are not fit for use because they either do not accurately account for the full scope of FLAG-related emissions activities or because they don’t provide the right level of disaggregation (separately reporting emissions and removals, for example). Furthermore, companies with a diverse portfolio of FLAG commodities may find it difficult to find a single secondary emissions factor data source to cover all commodity categories. This is especially true for measuring the impact of GHG removals, which have been introduced by the GHG Protocol and SBTi as an important GHG mitigation lever that tends to require significantly more complex and farm-specific measurement.

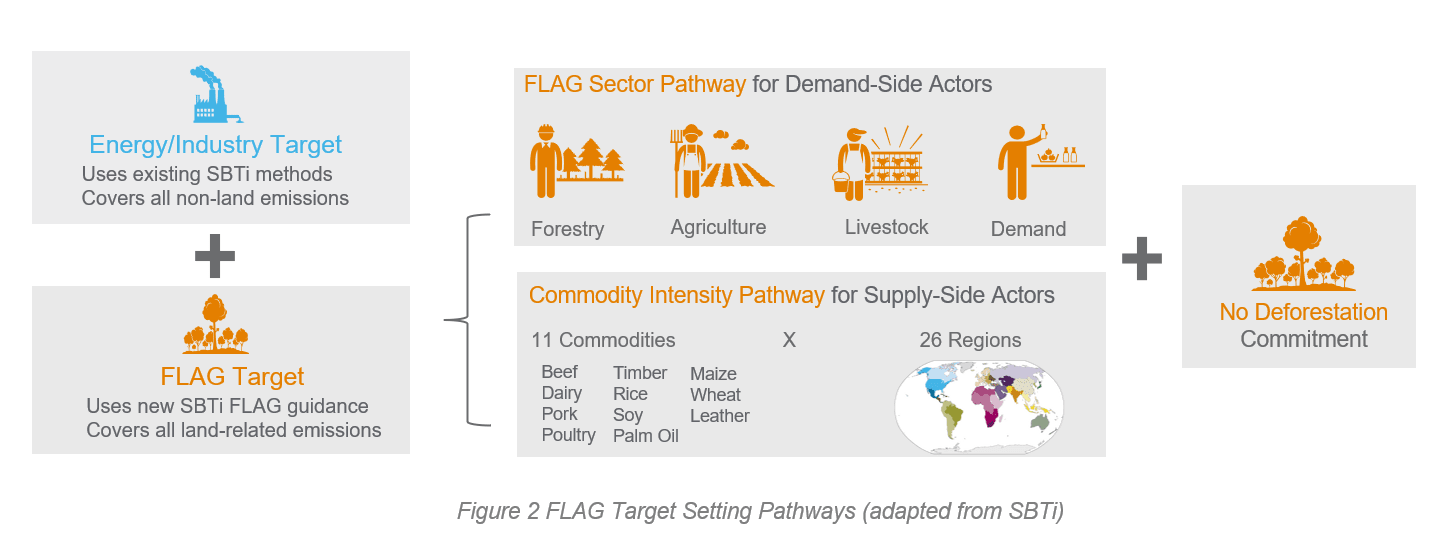

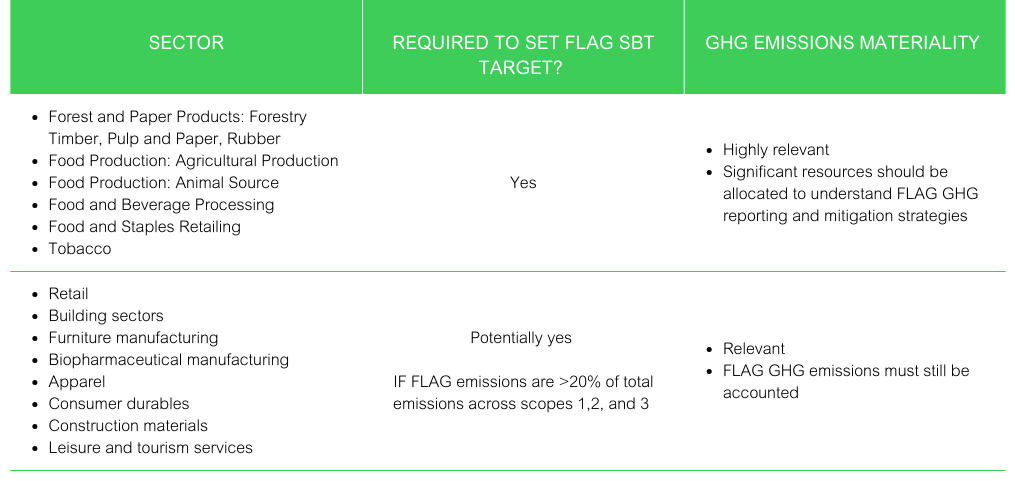

Challenge #3: Navigating the SBTi target setting framework: For companies seeking to go beyond emissions reporting, the gold standard for target setting is the SBTi. Following the release of the GHG Protocol’s Draft Land Sector and Removals Guidance, SBTi released complementary sector-specific guidance for setting targets on FLAG emissions. Critical components to the new guidance include a globally applicable mandate for all companies to measure FLAG emissions (regardless of sector), specific criteria for setting a separate FLAG target (in addition to an energy & industry target) and availability of new FLAG-specific abatement targets.

About 250 companies6 who have already set a target will need to update their targets within 6 months of the finalization of the new guidance.

.

.

How Schneider Electric Can Help

For companies that do business in FLAG-relevant sectors, understanding the new GHG Protocol reporting requirements is critical. Schneider’s dedicated experts can support sustainability teams in navigating the GHG Protocol draft guidance, especially if they are undergoing a FLAG GHG inventory for the first time.

Our teams can assist businesses in many ways, including the preparation of a step-by-step readiness plan for gathering data, calculating a FLAG GHG emissions baseline, access the right emissions factor datasets, aligning reporting approach with regulatory frameworks such as EUDR, setting FLAG SBTs, and creating strategies to mitigate FLAG emissions.

.

Table 1: Is FLAG material for your company?

.

How to Navigate the Journey to Enhanced FLAG Emissions Accounting and Target Setting

Companies should start now with FLAG accounting while the GHG Protocol guidance is being finalized. Although it’s unclear at this time what exact changes will be made in the finalized guidance, companies may expect some changes in regard to the following topics:

- Carbon dioxide removals

- Product carbon storage

- Sector-specific land management accounting requirements (e.g. timber and wood fiber)

- Bioenergy and other biogenic products

Furthermore, companies should expect some limited updates to the SBTi sectorial target setting guidance from FLAG, shortly following the release of the final GHG Protocol guidance (Figure 3). Although companies who have set targets using the Draft Sector Guidance will not be required to update their targets immediately, companies who have set targets before the release of the Draft guidance will have only 6 months to provide updated and aligned targets.

The key resources for further reading:

- Land Sector and Removals Guidance, Draft, Part 1

- Land Sector and Removals Guidance, Draft, Part 2

- Additional resources from the GHG Protocol (list of land sector calculation resources and sample reporting templates)

.

Figure 3 Expected timeline for the updates of FLAG related guidance and regulation.

.

Get in Touch with an ExpertWant to learn more? Contact us today and let our global experts help guide you with strategy and technology that drives action and impact.

.

Contributors:

.

Resources:

- https://ghgprotocol.org/sites/default/files/2024-07/Project-Overview-3-July-2024_0.pdf

- https://data.worldbank.org/indicator/AG.LND.AGRI.ZS

- https://ourworldindata.org/land-use

- https://ghgprotocol.org/sites/default/files/2023-12/Project%20Overview_18%20Dec%202023.pdf

- https://www.wri.org/research/traceability-and-transparency-supply-chains-agricultural-and-forest-commodities

- Companies in FLAG-designated sectors with their SBTi targets validated.