A Deep Dive into The Sustainable Finance Disclosure Regulation (SFDR)

SFDR – these 4 letters are creating a buzz for so many businesses and are driving forward the EU’s low-carbon transition. But for many organizations, there are still questions as to how this regulation is related to other disclosure mandates, who is affected, and how.

SFDR, or the Sustainable Finance Disclosure Regulation, is a major step to increasing transparency and greening the financial sector. It will have impacts for many organizations, but to understand the SFDR it is important to first understand where it fits in the hierarchy of sustainability legislation in the EU.

This hierarchy starts with the EU Green Taxonomy, the basis for all EU sustainability regulation. The Non-Financial Reporting Directive (NFRD), Corporate Sustainability Reporting Directive (CSRD), and Sustainable Finance Disclosure Regulation (SFDR) build off the classification system established by the Taxonomy and adds reporting and disclosure requirements for entities in scope. This information is critical for understanding the purpose and actionable items surrounding the regulations.

Sustainable regulations 101

What is the EU Taxonomy?

The EU Taxonomy is a classification system that translates the European Union’s climate and environmental objectives into a framework that recognizes and provides a common language for environmentally sustainable economic activities. In addition to identifying activities that contribute to at least one of the EU’s sustainability goals, the Taxonomy requires that economic activities “do no significant harm” to the environmental objectives and meet minimum social safeguards. It is a transparency tool that will introduce mandatory disclosure obligations for companies and investors, requiring them to publish their share of Taxonomy-aligned activities.

What is the Non-Financial Reporting Directive (NFRD)?

The NFRD aims to deliver a comprehensive corporate reporting framework with qualitative and quantitative information to facilitate the assessment of companies’ sustainability impacts and risks. The Directive requires large public-interest entities to disclose information in their non-financial statements concerning Environmental, Social, and Governance (ESG) matters. According to the EU Taxonomy, companies falling within the scope of the existing NFRD are expected to report on the extent to which their activities are sustainable.

What is the Corporate Sustainability Reporting Directive (CSRD)?

The CSRD extends the scope of the NFRD requirements to include all large companies (listed or not). This change broadens the scope of entities from 11,600 to 49,000 and means that all large companies are publicly accountable for their impact on people and the environment. The extended scope of the CSRD also includes small and medium-sized enterprises that have securities listed on regulated markets, except listed microenterprises. The EU Taxonomy will ensure that companies falling under the scope of the CSRD disclose their environmental performance information and their Taxonomy-aligned economic activities. CSRD aims to ensure alignment, specifically with the SFDR, and to reduce complexity and potential duplicative reporting requirements. It ensures that companies report the information that investors need to meet SFDR requirement.

What is the Sustainable Finance Disclosure Regulation (SFDR)?

SFDR is a regulation designed to complement corporate disclosures by creating a comprehensive reporting framework for financial products and financial entities. Different investment strategies will inevitably result in the funding of activities with varying levels of environmental performance. To address this, the SFDR categorizes financial products and distinguishes disclosure requirements for each. The SFDR links to the EU Taxonomy requirements by aligning its definition of “sustainable investments” with how the Taxonomy defines environmentally sustainable economic activities.

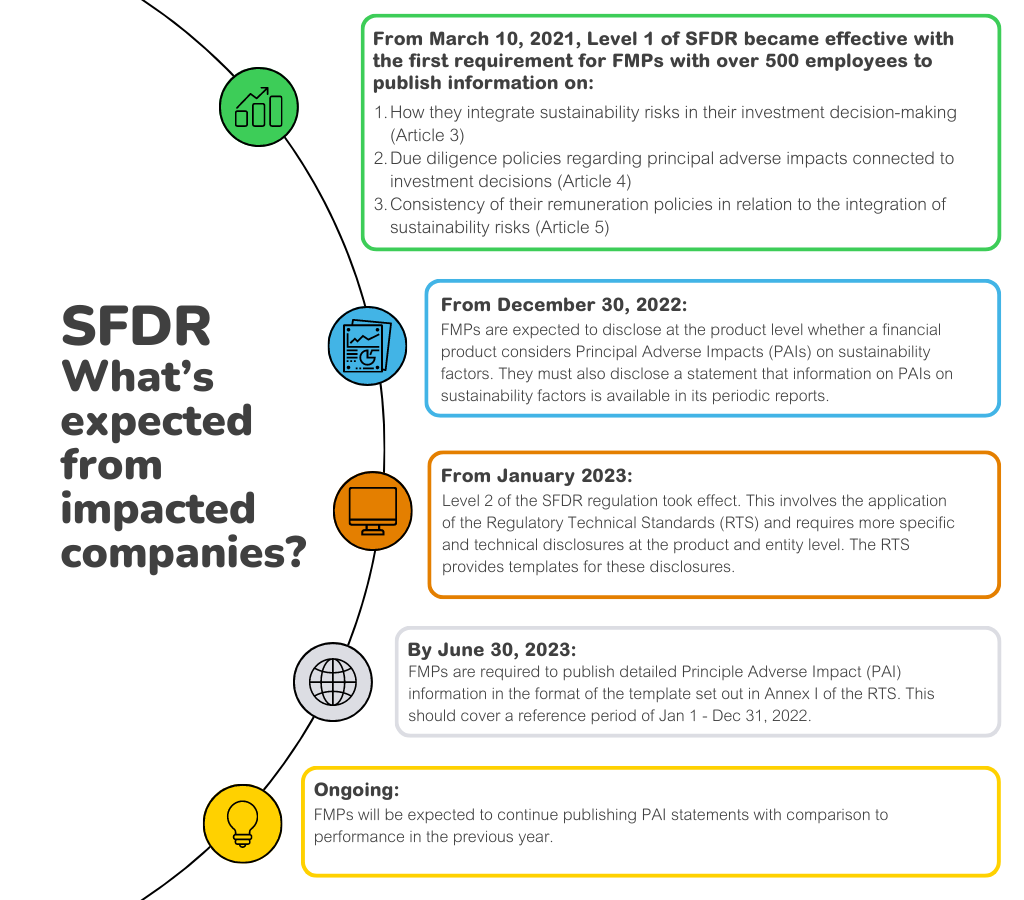

Who does SFDR impact, and when?

The SFDR will have both direct and indirect effects for various financial market participants (FMPs).

Several groups are directly impacted:

- FMPs in the EU: Such as investment firms that provide portfolio management, insurers providing insurance-based investment products (IBIPs), and pension product providers.

- Financial advisors in the EU: Such as investment firms that provide investment advice and intermediaries advising on IBIPs. Financial advisors with less than 3 employees are exempt from the disclosure obligation.

- Non-EU financial market participants: Investment managers and financial advisors who market and conduct services for EU financial products that are subject to SFDR regulation. The full list of financial market participants the SFDR impacts is available here.

Many other companies will be indirectly impacted. Portfolio companies or companies interested in attracting investments will have to get ready to provide ESG-related data to financial market participants for their disclosure. Investees will also be affected by a new invest-ability assessment. The SFDR and Taxonomy regulation outline criteria that investee companies will have to meet to qualify as sustainable investments.

How are financial products classified under SFDR?

The SFDR details product-level classifications that are used to disclose varying strengths of sustainability considerations in their investment strategies. All Products must be classified as falling under either article 6, 8, or 9, and follow reporting requirements as defined below:

- Article 6 covers products that traditionally do not integrate sustainability within the investment process. FMPs must disclose how they integrate sustainability risks in their investment decisions and how the impacts of sustainability risks affect the returns on these financial products. Article 6 products are classified as “grey” funds and require pre-contractual and website disclosures.

- Article 8 includes products that promote environmental or social characteristics and follow good governance practices. These are classified as “light green” funds and require pre-contractual disclosures, website disclosures, and periodic disclosures.

- Article 9 is any product that has a clear sustainable investment objective. As defined by the SFDR regulation text, a sustainable investment is “an investment in an economic activity that contributes to an environmental or social objective, provided that the investment does not significantly harm any environmental or social objective and that the investee companies follow good governance practices.” These are classified as “dark green” funds and require pre-contractual disclosures, website disclosures, and periodic disclosures.

SFDR Principal Adverse Impact indicators

Principal Adverse Impacts (PAI) are impacts of investment decisions and advice that result in negative effects on sustainability factors. Sustainability factors are defined as environmental, social and employee matters, respect for human rights, and anti-corruption and anti-bribery issues. Examples of PAI indicators include increased GHG emissions or energy consumption, production of hazardous waste, and a worsening gender pay gap or board diversity.

Principal Adverse Impacts are intended to be collected at the entity/company/asset level. Data collection includes information on relevant ESG policies as well as specific PAI metrics. Several ubiquitous FMPs are expected to disclose PAI information on a financial product/fund level. This information must include how PAIs are integrated into all aspects of the financial product.

Schneider Electric is working with several FMPs to develop ESG surveys that collect PAI-related data for public reporting. These surveys are created, distributed, and published in our data management platform, Resource Advisor, which provides a single view for all ESG data and allows for in-depth visualization, year-over-year comparison, and public reporting assistance. More developments on Schneider Electric’s sustainable finance work with FMPs is available here.

What steps can organizations take to prepare?

- Identify any fund-level ESG practices relevant for reporting under the SFDR and develop a compliance roadmap.

- Develop a data collection strategy for fund and asset-level information and disclosure.

- Prepare entity-level evaluations and disclosures on sustainability risk integration policies, remuneration policies, and PAI statements.

- Identify whether products meet Article 6, Article 8, or Article 9 requirements and prepare appropriate product-level disclosures. Understand that financial products marketed as green products (light – Article 8, or dark – Article 9) trigger additional disclosure requirements.

This article is written by Kevin Mikita & Victoria Mansfield. Both are Sustainability Consultants for Schneider Electric Sustainability Business and specialize in delivering ESG services to clients.

Subscribe to receive the latest energy & sustainability perspectives. For more information about business ESG disclosures or to develop an SFDR compliance roadmap get in touch.

This article first appeared in the GRESB newsroom. To view, click here.