Unpacking CSRD: The Complexities of Cross-Border Reporting

Read time: 3-4 minutes

Not just another compliance scheme

In an era where corporate responsibility takes center stage, the EU’s Corporate Sustainability Reporting Directive (CSRD) emerges as a pivotal framework. Mandating the publication of verified sustainability information, the CSRD marks a significant shift in reporting standards. As the deadlines for implementation are near, companies within its scope must gear up to meet its requirements.

In an era where corporate responsibility takes center stage, the EU’s Corporate Sustainability Reporting Directive (CSRD) emerges as a pivotal framework. Mandating the publication of verified sustainability information, the CSRD marks a significant shift in reporting standards. As the deadlines for implementation are near, companies within its scope must gear up to meet its requirements.

Filippo Antonio Capizzi, Sustainability Solutions Architect at SE’s Sustainability Business, says, “CSRD transcends the Non-financial Reporting Directive (NFRD), representing more than a mere compliance directive. It demands substantive action from companies, offering a more extensive framework for reporting.

Filippo Antonio Capizzi, Sustainability Solutions Architect at SE’s Sustainability Business, says, “CSRD transcends the Non-financial Reporting Directive (NFRD), representing more than a mere compliance directive. It demands substantive action from companies, offering a more extensive framework for reporting.

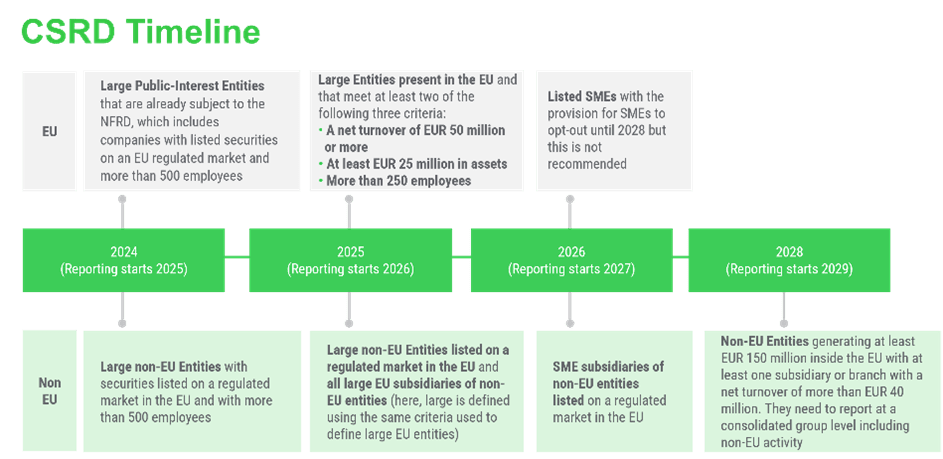

The CSRD, slated for implementation in stages starting from financial year 2024, casts a wide net, encompassing large and listed companies as well as large non-listed companies, listed SMEs, and branches and subsidiaries of non-EU companies. By providing a clear timeline, the CSRD sets the stage for a unified approach towards sustainability reporting across the EU.

The thresholds and the stages of implementation are listed in the table below.

Different approaches taken by member states

While the CSRD establishes a common standard at the EU level, member states retain some flexibility in how they transpose it into their national legislation. This flexibility has already been demonstrated by several countries in their transposition efforts. For instance, France's implementing legislation includes additional requirements pertaining to non-financial information. Finland has broadened the scope of reporting to encompass large co-operatives and pension funds, while Romania has maintained its national thresholds for large companies, differing from the EU-prescribed ones. The Czech Republic and Hungary list financial thresholds in national currencies, deviating slightly from the EU norms.

Hungary’s “ESG Act,” extends beyond the CSRD minimum requirements by also mandating companies to conduct corporate due diligence. However, it's important to recognize that while the Act establishes a foundation for CSRD, its implementing decrees are currently in progress.

These national deviations necessitate a nuanced approach for companies operating across multiple jurisdictions, highlighting the importance of staying abreast of local regulatory variations.

The stages of national transposition in the 27 EU Member States as well as the 3 additional

EEA states, updated as of June 10, 2024

A holistic approach is needed

As the deadline for CSRD reporting approaches, companies must initiate compliance preparations, by conducting a double materiality assessment. This crucial process identifies key ESG topics most material to the company’s financial and operational impacts, guiding which sets of ESRS standards are mandatory for reporting. A thorough review of current reporting practices to spot discrepancies with CSRD mandates is the essential subsequent step.

Equipped with the relevant knowledge, companies are encouraged to leverage technological solutions to streamline data collection, analysis, and reporting processes, thereby enhancing efficiency and accuracy. Finally, companies also need to keep abreast of the various national nuances in reporting requirements. Engaging with external stakeholders, such as industry peers, regulators, and sustainability experts, can provide valuable insights and best practices for CSRD compliance. “Schneider Electric offers a holistic approach tailored for companies navigating the nuances of cross-border CSRD reporting,” says Filippo.

In conclusion, the CSRD heralds a new era of corporate accountability and transparency, shaping the sustainability landscape across the European Union. Companies within its purview must embrace this paradigm shift, viewing it not merely as a regulatory obligation but as an opportunity to drive positive change and enhance long-term value creation.

Actions for consideration:

-

Determine which business department owns scoping or dedicate an ESG department.

-

Align on data-gathering parameters.

-

Collaborate with legal to identify which entities within the company structure to include in the reporting strategy.

-

Plan for regular updates on reporting landscape.

By proactively preparing for CSRD reporting, companies can not only meet regulatory requirements but also foster stakeholder trust, mitigate risks, and seize competitive advantages in an increasingly sustainability-conscious marketplace.

Explore more climate-related rulings and regulations here.

To learn more on CSRD, watch our on-demand webinar "Unpacking Regulations: Unlocking CSRD Reporting."

Also, sign up for our upcoming webinar, "Mastering Sustainability Reporting" on September 12, 2024.

Our subject matter experts are here to help. Don’t hesitate to call on us to ease your way into this regulatory future. https://perspectives.se.com/.

Contributor:

Madli Rohtla, Sustainability Analyst

Madli Rohtla, Sustainability Analyst